Meet the Team

Carl A. Lutz

ChFCⓇ, RICPⓇ, CLTC, CExP™

Founder

Nicholas Phillips

Chief Technology Officer

Hannah Schade

UX & UI Designer

My Contributions

Collaborated with Founder & CTO on functionality and look/feel.

Created digital flyers, presentations,

and pamphlets for trade shows.

Proposed designs for both the marketing and white labeled site.

Created worksheets and workbooks for workshops for an intro into the tool.

The Concept

Most budgeting tools are really expense tracking tools. We see the value in tracking your expenses but first you need to know how much is available to spend. It is the difference between looking in the rear view mirror versus out the windshield. The rear view mirror tells you where you have been. Looking out the windshield tells you where you are going.

User Profiles

Our two main users are both Financial Advisors who are in different stages within their career.

Matt, 28 years old - Financial Advisor

Matt is new in his career, he is motivated and eager to start building his business and connecting with potential clients.

Lauren, 49 years old - Financial Advisor

Lauren has established her career within the industry is and is looking to take her business to the next level.

The Opportunity

”I [Carl Lutz- Founder] discovered that they [other Financial Advisors] too were frustrated with the lack of tools available for analyzing cash flow in a logical, simplistic, and impactful way.”

. . . . .

How might we…

How might we create a software/tool that allows financial advisors to find and retain new clients by focusing and analyzing their clients’ cash flow in a simplistic and impactful way, so that the clients knows where all their money is going before they spend it?

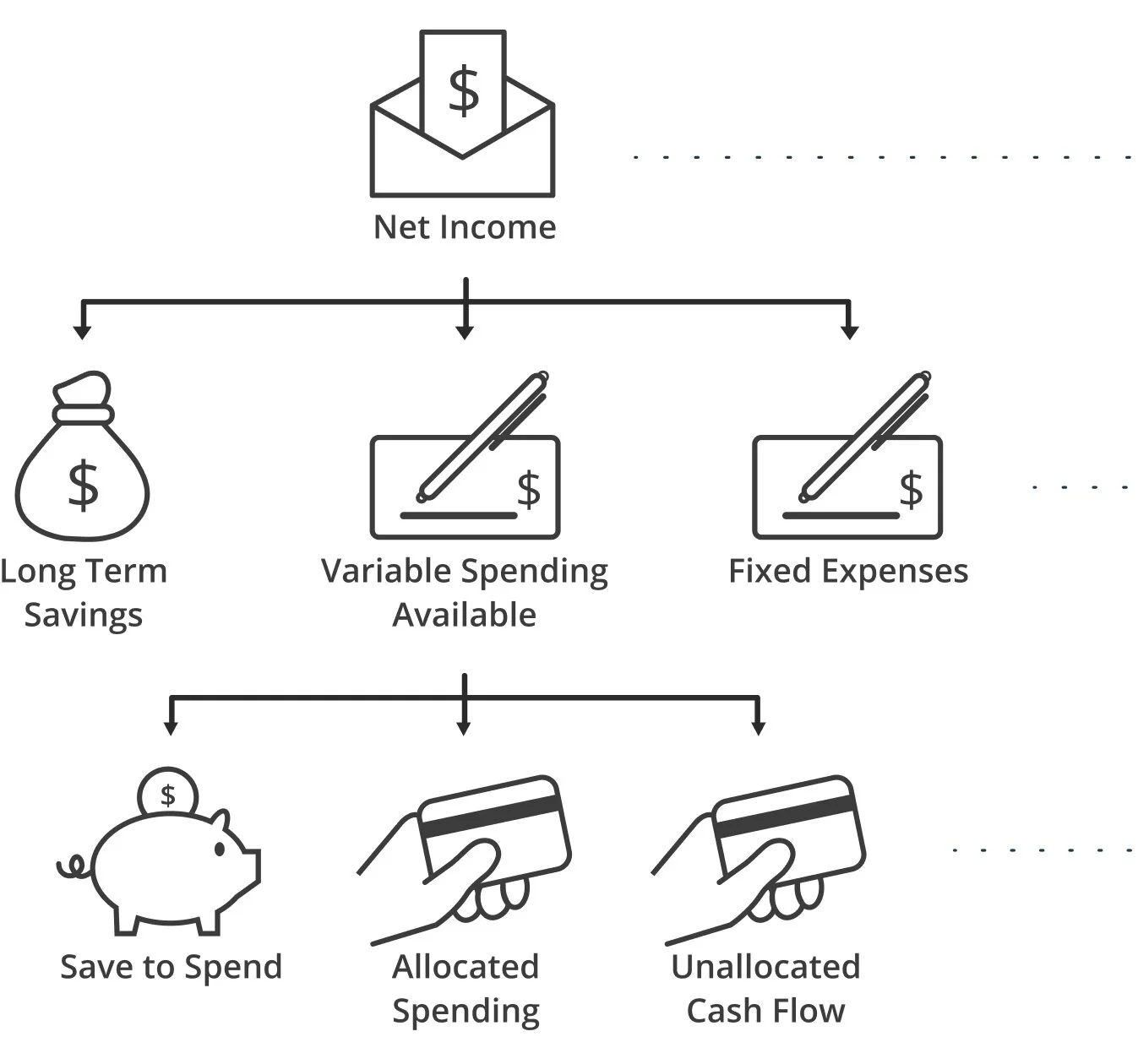

Cash Flow is Complex!

Breaking down the different components that make cash flow so complicated.

Net Income

Different frequencies of pay - monthly, weekly, bi-weekly, twice per month.

Savings

Understanding difference between long term savings and short term savings.

Expenses

Traditional budgeting commingles fixed and variable expenses.

Payment Options

Too many options for paying bills - Auto pay, credit & debit cards, Venmo, checks, cash, etc.

Income Tax

Over withholding and under withholding of income taxes.

How Can We Simplify it?

Created a flow chart that shows how clients can break down their net income to result in their unallocated cash flow.

Convert your income and expenses into a monthly number.

Pay yourself first, put money away in your long-term savings

account.Separate your fixed expenses from your variable

expenses. Solve for what’s available for variable spending.

Manage your variable spending by allocating some of your

spending, save to spend and by using one account for all

variable spending.

Solution

A tool that allows advisors to work with their clients to break down their cash flow into four different categories based on a monthly number; net income, long term savings, fixed expenses, and variable expenses.

The output of the tool, informs the client how much unallocated cash flow they have for the month after they input all their information.

Goal

Create two sites, one that educates advisors about the tool and one that can be used by both the advisor and client to manage

cash flow in a simplistic and impactful way.

Marketing Site

A platform to educate Financial Advisors about Cash Flow

Mapping® by providing testimonials, features overview,

pricing options, and more.

Cash Flow Calculation Tool

A white-labeled website where Financial Advisor clients can

log into from anywhere to get access to their cash flow

maps and see the recommendations they make.

Marketing Site

We created a marketing site to send out to Financial Advisors to teach them about the Cash Flow Mapping® tool. The site provides

the advisors with an overview of what the tool does, how it can help them, introduction video on how to get started, and lots more.

The site also features our FAQ’s, articles related to the topic of cash flow, our pricing model, and testimonials. The testimonials feature

both advisors and their clients using the tool. Our pricing model gives the advisors both a monthly and annual option with a

list of benefits for each plan.

If the advisors want to learn more about how they can use their tool within the practice, they can request a discovery call, to join one of

our webinars or even chat with directly with the team via a chat bot.

Cash Flow Calculation Tool

A white-labeled website where Financial Advisor clients can log into from anywhere to get access to their cash flow maps and

see the recommendations they make. By showing clients how to enter information about changes to their cash flow—such

as a new home purchase, change in income or other expenses—you can keep your name top of mind year-round.

The site breaks down the clients net income, long-terms savings, fixed expenses and variable expenses in a way that is easy to

understand. After filling out all information with the client, they will be able to see what unallocated cash flow is “left over”

for them month that they can play with. It allows the client to see where all their money is going each month, before they spend it.

The screens below, walk through the advisor dashboard, client profile and the 5 stages to the cash flow analyst tool.

Advisor Dashboard

A place for advisors to search and view their clients.

Advisor View of Client Profile

Advisors and clients can see their personal profile with all their maps.

Viewing a Map | Net Income

Advisor then walks their client through inputing all their pay stub information to determine with Net Income.

Viewing a Map | Long-Term Savings

Viewing a Map | Fixed Expenses

Viewing a Map | Variable Expenses

Viewing a Map | Summary

Testimonials

“I recently used CFM with a client and had great results. The simple, easy-to-use format allowed me together with the client to map out their current cash flow and where it is going. It is a great exercise with a couple because it takes them through a systematized "walk through" of their monthly cash flow, only focusing on the main monthly expenses.

I would highly recommend this tool to other advisers. It is simple, intuitive, and most importantly effective.”

- Financial Advisor

“What an amazing tool!! For years my wife and I have struggled to understand how we could be living paycheck to paycheck when we made a good living. Asking ourselves each month, "Where did all of the money go?" We tried budget spreadsheets, banking software, and many other solutions. After using Cash Flow Mapping for just a couple of months the results have been astounding. We are able to easily cover all fixed expenses, have money for the fun things we want to do, and put more money away for our future. It is incredible how this amazingly simple tool provides this level of insight into what was an extremely complex problem for my family. I finally feel like we are "telling our money where to go rather than wondering where it went." Thank you Cash Flow Mapping.”

- Client to a Financial Advisor using Cash Flow Mapping®